The Walt Disney Company, often simply referred to as Disney, stands as one of the most iconic and influential entertainment conglomerates globally. Known for its magical theme parks, timeless films, and vast media presence, Disney's net worth is a topic of great interest to investors, analysts, and fans alike. This article delves into the financial backbone of this legendary corporation, exploring its assets, revenue streams, and growth potential. If you're curious about how Disney's financial empire has expanded over the years, you're in the right place.

From its humble beginnings in the early 20th century to its current status as a global powerhouse, Disney's journey is nothing short of remarkable. Its ability to adapt to changing market trends while maintaining its core values has been a key driver of its success. Understanding Disney's net worth requires looking beyond the surface and examining its diverse portfolio of businesses.

In this article, we will explore the various components that contribute to Disney's financial success, including its media networks, theme parks, and consumer products. Whether you're an investor seeking insights or simply a fan curious about the financial side of Disney's magic, this article aims to provide a detailed and insightful overview.

Read also:Enma Stone Husband The Ultimate Guide To Understanding This Fascinating Topic

Table of Contents

- Introduction

- History of Disney's Financial Growth

- Net Worth of Disney Company

- Revenue Streams

- Disney's Assets

- Investments and Acquisitions

- Challenges and Opportunities

- Future Growth Potential

- Key Statistics and Data

- Conclusion

History of Disney's Financial Growth

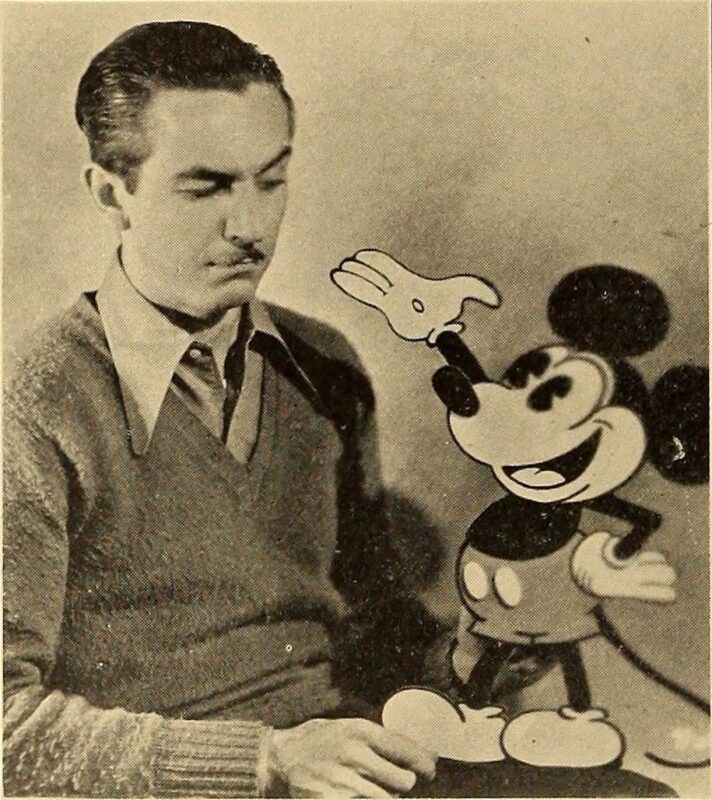

Disney's financial journey is a testament to its ability to innovate and adapt. Founded in 1923 by Walt Disney and his brother Roy O. Disney, the company started as a small animation studio. Over the decades, it has transformed into a multi-billion-dollar empire. Key milestones, such as the creation of Mickey Mouse, the launch of Disneyland, and the acquisition of major studios, have significantly contributed to its financial growth.

The company's strategic expansion into various industries, including television, film, and digital media, has been instrumental in boosting its net worth. Disney's ability to leverage its brand across different platforms has allowed it to maintain its competitive edge in the ever-evolving entertainment industry.

In recent years, Disney's focus on streaming services, particularly Disney+, has opened new revenue streams and attracted a global audience. This diversification has been crucial in maintaining steady financial growth despite economic challenges.

Net Worth of Disney Company

The net worth of Disney Company is a reflection of its vast assets and revenue-generating capabilities. As of 2023, Disney's market capitalization exceeds $200 billion, making it one of the largest entertainment companies in the world. This figure represents the total value of the company's outstanding shares and serves as a key indicator of its financial health.

Beyond market capitalization, Disney's net worth includes its tangible and intangible assets, such as theme parks, intellectual property, and brand value. The company's strong financial position allows it to invest in new projects and acquisitions, further enhancing its growth potential.

Understanding Disney's net worth requires analyzing its various revenue streams and assessing its long-term financial strategies. This comprehensive approach provides a clearer picture of the company's financial strength and future prospects.

Read also:What Year Were Mampms Created A Comprehensive Timeline And Fascinating History

Revenue Streams

Media Networks

Disney's media networks division is a significant contributor to its overall revenue. This segment includes popular channels such as ABC, ESPN, and Disney Channel. The company's investment in digital platforms, like Hulu and Disney+, has further diversified its media offerings and expanded its audience reach.

Key revenue drivers in this division include advertising, subscription fees, and content licensing. Disney's ability to produce high-quality content and leverage its brands across multiple platforms has been a key factor in its success. Here are some of the notable media networks under Disney's umbrella:

- ABC

- ESPN

- Disney Channel

- Hulu

- Disney+

Theme Parks and Resorts

Disney's theme parks and resorts division is another major revenue stream. With iconic locations such as Disneyland and Walt Disney World, this segment attracts millions of visitors annually. The company's focus on creating immersive experiences and expanding its global presence has contributed to its financial success.

Revenue from ticket sales, hotel accommodations, and merchandise plays a crucial role in this division's performance. Disney's ability to innovate and introduce new attractions ensures a steady flow of visitors, even in challenging economic conditions. Some of the key parks and resorts include:

- Disneyland Resort

- Walt Disney World Resort

- Disney Cruise Line

- Shanghai Disneyland

Disney's Assets

Disney's assets encompass a wide range of properties, both tangible and intangible. These include its theme parks, media networks, and intellectual property. The company's vast portfolio of characters and franchises, such as Marvel, Star Wars, and Pixar, adds significant value to its brand.

In addition to its physical assets, Disney's brand value is a crucial component of its financial strength. The company's reputation for quality and innovation has earned it a loyal customer base and strong brand recognition worldwide. By continuously investing in new projects and technologies, Disney ensures the longevity and relevance of its assets.

The following table highlights some of Disney's key assets:

| Asset Category | Examples |

|---|---|

| Theme Parks | Disneyland, Walt Disney World |

| Media Networks | ABC, ESPN, Disney Channel |

| Intellectual Property | Marvel, Star Wars, Pixar |

Investments and Acquisitions

Disney's strategic investments and acquisitions have played a pivotal role in its financial growth. The company's acquisition of major studios, such as Pixar, Marvel, and Lucasfilm, has expanded its content library and enhanced its creative capabilities. These acquisitions have not only increased Disney's revenue but also strengthened its position in the entertainment industry.

Recent investments in streaming technology and digital platforms reflect Disney's commitment to staying ahead in the rapidly evolving media landscape. By acquiring companies like Hulu and investing in Disney+, the company ensures its relevance in the digital age. These moves have been well-received by investors and have contributed to Disney's financial success.

Here are some of Disney's notable acquisitions:

- Pixar

- Marvel Entertainment

- Lucasfilm

- 21st Century Fox

Challenges and Opportunities

Despite its financial success, Disney faces several challenges in today's competitive market. The rise of streaming services and changing consumer preferences pose significant threats to traditional media businesses. Additionally, global events, such as pandemics, can impact theme park attendance and overall revenue.

However, these challenges also present opportunities for growth and innovation. Disney's focus on digital transformation and expansion into new markets highlights its adaptability and forward-thinking approach. By investing in technology and diversifying its offerings, the company remains well-positioned for future success.

According to a report by Statista, the global entertainment market is expected to grow significantly in the coming years, providing Disney with ample opportunities to expand its reach and increase its net worth.

Future Growth Potential

Disney's future growth potential is vast, driven by its strategic investments and innovative approaches. The company's focus on streaming services, international expansion, and technological advancements positions it well for continued success. By leveraging its strong brand and vast content library, Disney can attract new audiences and increase its revenue streams.

Additionally, Disney's commitment to sustainability and corporate responsibility aligns with evolving consumer values, further enhancing its reputation and financial prospects. As the entertainment industry continues to evolve, Disney's ability to adapt and innovate will be key to maintaining its financial dominance.

Investors and analysts remain optimistic about Disney's future, citing its strong financial position and diverse portfolio of businesses as key drivers of growth.

Key Statistics and Data

Data and statistics provide valuable insights into Disney's financial performance and market position. According to the company's latest financial report, Disney's total revenue for 2023 exceeded $80 billion, with significant contributions from its media networks and theme parks divisions.

The following statistics highlight Disney's financial strength and growth potential:

- Market Capitalization: Over $200 billion

- Annual Revenue: Exceeds $80 billion

- Theme Park Attendance: Over 150 million visitors annually

- Streaming Subscribers: Over 200 million globally

These figures demonstrate Disney's ability to generate substantial revenue and maintain a strong financial position in a competitive market.

Conclusion

In conclusion, Disney's net worth is a reflection of its financial strength, strategic investments, and innovative approaches. From its iconic theme parks to its vast media networks, Disney's diverse portfolio of businesses ensures its continued success in the entertainment industry. Understanding the various components that contribute to Disney's financial success provides valuable insights into its future growth potential.

We invite you to share your thoughts and insights in the comments section below. Whether you're an investor or a fan, your feedback is valuable to us. Additionally, feel free to explore our other articles for more in-depth analysis of the entertainment industry and beyond. Thank you for reading!